Argus Traps

General Variable Naming

Argus allows for variables across different sections, i.e., Area Measures and Expense Groups, to be named the same even if the contents of said metrics are different. This provides the opportunity for error across the model as variables can be incorrectly referenced by user(s).

Expense Groups

Argus allows for expenses to be passed through multiple times within the same recovery method. While the program will flag the potential error utilizing the “![]() ” icon, it is very easy to miss this warning if the pools are being updated without looking at the actual recovery methods. Additionally, its common to see this same icon when no error exists, so it’s easy for User to ignore.

” icon, it is very easy to miss this warning if the pools are being updated without looking at the actual recovery methods. Additionally, its common to see this same icon when no error exists, so it’s easy for User to ignore.

Fixed Pro Rata Shares

In markets such as New York, it is very common for tenants to have fixed PRS in lieu of calculated PRS based a given denominator. When applying such methodologies within Argus, users should be sure to make sure the method is applied appropriately when compared to the square footage.

- Example: JP Morgan Chase occupies four (4) floors in ABC Office Building modeled in Argus as four (4) different suites. Per CAM Reconciliation, Tenant’s PRS is fixed at 30%. Applying the recovery method with a fixed PRS to each suite would result in erroneously recovering 4x the amount intended as Argus will utilize 30% four times. ACG recommends applying this method to only one (1) suite and naming such recovery method “JP Morgan (ALL)” in order to avoid this error.

Apply to Tenants

This function is available for selection under Revenues/Expenses/Capital with the intention of linking a specific item only to a subpopulation of the property. When calculating the cash impact of the item, Argus works appropriately; however, Argus will not pass through the value of the item in the event this is intended to be a recoverable expense. Argus is deceiving in that the expense can be included in an expense group typical to other expenses; however, the net impact will be zero. If User desires to use this calculation method, ACG recommends only utilizing the Apply to Tenants function for revenues, capital, and non-recoverable expenses

In-Use Recovery Methods

In-Use Recovery Methods: Argus allows for User to accidentally delete any recovery methods that are in use by a current tenant and/or the MLAs. When this occurs, any impacting tenants/MLAs will be updated to a “None” recovery method without notification to User.

Workaround: All MLA recovery methods should be flagged (i.e., *MKT-). This will allow for any users to see what market methods are “in use” on the Recoveries screen. Only then should User delete recovery structures that are blank under “Applied to Tenants” AND not flagged as *MKT. To further ensure this error is not made, User should always conduct a before and after when cleaning up old/unused variables to confirm there is no impact to the Cash Flow.

MLAs- Percentage Rent

By default, a new market leasing assumption, is set to “Continue Prior” for all components of percentage rent. If left unchanged, Argus will speculatively calculate percentage rent by applying any in-place methodologies (including sales as inflated and breakpoints) to speculative tenants created by the MLA. ACG recommends either updating MLAs to reflect “None” or applying specific assumptions that are applicable to the population of tenants using that MLA.

Operating Expenses- Recoverable %:

Recoverable % option in Operating Expenses allows User to indicate an expense is fully or partially non-recoverable. When a new expense group is created, the recoverable % indicated in the Operating Expenses screen will serve as the default recoverable percentage in the event this expense is included in an expense group. Argus users should be careful to not assume that the use of 0% in this field for any expenses means that expense is not being recovered. Once included in an expense group, users have the option to override the recoverable percentage, thus passing through a “non-recoverable” for reimbursement.

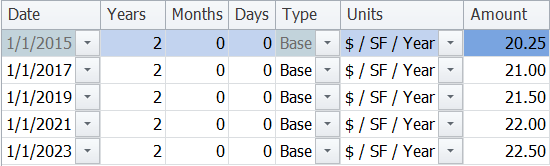

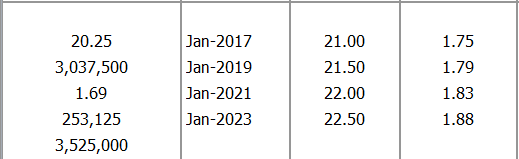

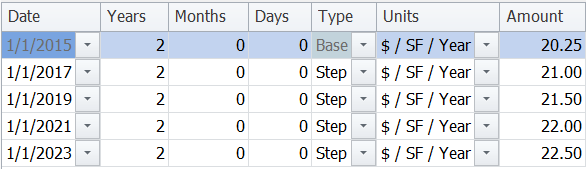

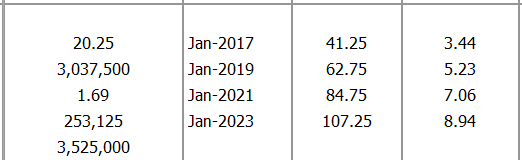

Rent Steps in Rent Roll

Any use of the “Step Rent” function, is understood as incremental increases over Base Rent in lieu of resetting base rent. This option is commonly misused and results in materially overstating future base rent. See example below.